North Carolina’s General Assembly has done a superb job managing the state’s finances. However, there is a time bomb ticking and it will go off if we don’t defuse it now. What is this potential financial disaster? The state’s pension fund.

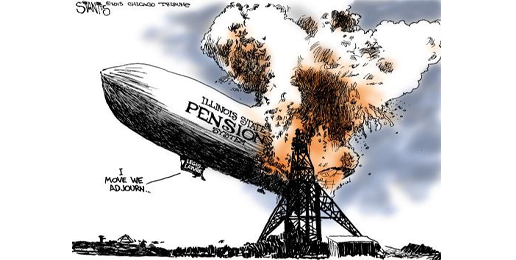

Look around the country and you’ll see the problem everywhere, especially from blue states who are so irresponsible that they are beyond help. We all know who these fiscal basketcases are. Here is an excerpt from Fox Business:

And Connecticut isn’t the only state struggling with a debt crisis: California, Illinois, New Jersey and New York are unable to make pension payments to retired government workers.

In Illinois, for instance, vendors wait months to be paid by a government that’s $30 billion in debt, and one whose bonds are just one notch above junk bond status, according to Daniels. New York’s more than $356 billion in debt; New Jersey more than $104 billion; and California more than $428 billion.

“They’re just one of a number of states, including some of the biggest states, that are in deep water,” Daniels said. “I think it is irretrievable. Pensions is the core of it. It’s not the only fiscal recklessness that they have practiced, but in some of those cases, the bill are genuinely unpayable.”

God forbid, North Carolina becomes like that. So far, Republicans have managed this behemoth. But drastic changes are going to have to be made. Instead of providing pensions, the state employees may have to opt for 401k’s like everyone else. Here is an excerpt from Civitas:

NC’s pension fund is falling further and further behind promised benefits, causing the unfunded liability to grow to $7.9 billion. The $7.9 B liability is a dramatic reversal from just 2005, when the pension plan actually had a $3 B surplus. An $11 billion spike in unfunded liabilities in 13 years should raise some red flags.

Moreover, this isn’t a future problem to be addressed at a later date, but has major budget implications right now.

For instance, the state budget passed earlier this summer requires pension contributions from state agencies of 12.29 percent of payroll (see pg. 203). That comes to a rough estimate of almost $1.5 billion in taxpayer dollars in this year’s budget going toward retiree pension payments. That’s more money than the budget devotes to the entire community college system, and about half spent on the entire UNC system.

The 12.29 percent rate is up nearly by half from the 8.33% used just six years ago. In dollar terms, the nearly $1.5 billion in taxpayer funds for pension benefits is up from about $800 million just six years ago – a staggering spike of about 85 percent. In short, pension obligations are ballooning at an unsustainable pace.

State employees may not like 401k’s but that’s too damn bad. Try and find a company in the private sector that provides pensions. You’ll be hard pressed.

Source:

https://www.foxbusiness.com/politics/these-american-states-are-drowning-in-irretrievable-debt

https://www.nccivitas.org/civitas-review/state-pension-funds-liabilities-continue-grow/

No comments:

Post a Comment